I’d like to explain … well … why this website exists.

Afford Anything promotes a handful of radical ideas:

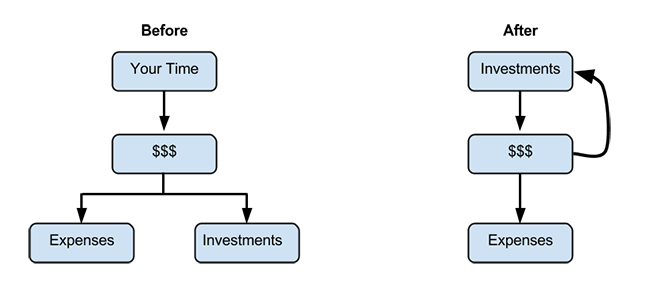

#1: You can create financial independence — the ability to quit trading-time-for-money, because your investments cover your bills.

#2: Financial independence comes from passive income.

#3: To build passive income, you’ll first need to create a gap between what you earn and what you spend. Your job is straightforward: build the gap, invest the gap, repeat.

Once you reach financial independence, your options explode. You don’t have to work in a crummy cubicle. You don’t have to punch a time clock. You don’t have to serve irritating clients. You can spend more time with family and friends. You’ll run your own life.

Here’s a list that summarizes 12 of Afford Anything’s bedrock principles. This list might help you step closer to financial independence.

#1: You Can Afford Anything. You Just Can’t Afford Everything.

Don’t tell me your values. Show me how you spend your money, and I’ll know what you value.

Don’t tell me, for example, that you “can’t afford” to save money, travel or invest if you’re simultaneously buying nice clothes and hitting the bars.

There’s nothing wrong with clothes and bars as a deliberate, conscious choice. But don’t claim that bigger goals are out-of-reach. Don’t utter the self-defeating phrase “I can’t afford it.” That’s weak. It’s disempowering. It’s a limiting belief.

Instead, ask yourself: “How do I afford everything else in my life? How do I afford my iPad? My new-ish car? My restaurant habit?”

There’s nothing wrong with buying an iPad and enjoying a five-star meal. The problem emerges when you blindly adopt those habits while simultaneously claiming that you “can’t afford” something else.

#2: Look for Answers, Not Obstacles.

With the exception of, say, colonizing Jupiter or understanding why Celine Dion is so popular, you can accomplish pretty much anything. So instead of saying “I can’t,” start phrasing your questions with, “How can I?”

For example:

- Instead of: “I can’t save another dime.”

- Try: “How can I shave an extra $50 from this month’s spending?”

- Instead of: “I can’t find any good real estate investments nearby.”

- Try: “How can I find good real estate deals? How can I get comfortable with foreclosure auctions and short sales? How can I find properties that aren’t MLS-listed? How can I invest in other cities and towns that have better deals? How else can I get creative?”

#3: Money Doesn’t Buy Stuff. It Buys Choices.

It’s fashionable to make trite statements like “money isn’t everything,” “money doesn’t matter,” or “I’d rather be happy than rich.”

Those sentiments, frankly, are baffling. Why would most people work 8+ hours everyday, only to claim “money doesn’t matter?” Clearly it does matter; that’s why most people wake up to an alarm.

When people say, “money doesn’t matter,” they’re trying to say, “buying fancy crap doesn’t matter.” That’s a sentiment I endorse. But it also misses the point.

The highest and best purpose of money isn’t to fill your life with $10,000 diamond-encrusted headphones (yeah, that’s a thing); it’s to maximize your choices and freedom.

Want to switch jobs? Let one parent stay-at-home? Move to the beach? You’ll need cash.

I’m not saying you need millions. But you’ll need some money. Money brings you mobility and opportunity – which are far more valuable than big-screen TVs and random gadgets.

Money (in sufficient quantity) gives you the freedom to quit your job, if you choose. Once you have enough investments, you’ll decide exactly how you spend each day. You can choose to keep working, if that’s your calling. Or you could choose to stop. Your decision is entirely in your hands, and “How can I buy groceries?” isn’t a question that enters the picture. You’ve already conquered that part. You’re exercising choice.

That’s why money matters.

#4: The Best Thing Money Buys is Time.

You can choose to spend you money however you’d like. But I recommend you spend money buying the world’s most rare, precious asset: Time.

Time is the great equalizer. Everyone gets 168 hours per week. We can’t change this. Our time also has an expiration date. (That’s a polite way of saying that we’re all going to die.)

Money, on the other hand, is unlimited. If it slips away, we can make more.

Time is our most limited — and therefore our most valuable — asset. So why squander and waste time while clutching onto pennies?

At the day-to-day level, this means you shouldn’t be an extreme cheapskate (unless it’s genuinely need-driven). Don’t squander your Saturday visiting three grocery stores chasing buy-one-get-one deals. Spend the extra $30 buying all your groceries in one spot so you can devote those two hours to enjoying a long, lingering brunch with your friends. Don’t waste hours clipping coupons, washing Ziploc bags and bisecting dryer sheets. Pay the extra $10 so you can spend an hour kicking a soccer ball with your kids.

Spend your money buying back your time.

#5: Rebel Against the Norm.

Society holds strange expectations around how we should spend our money.

If we spend $15,000 on a Honda Civic, nobody questions the purchase. No one asks, “How could you afford it?” or exclaims, “Wow, you’re soooo lucky!”

But if we spend this same $15,000 on a scuba-diving trip through the South Pacific islands, people raise eyebrows. They assume we’re filthy rich, or we’re up to our eyeballs in credit card debt, or we’re sponging off some sexy benefactor.

Nobody seems satisfied with the simple, honest answer: “I hustled hard and I spent waaayyy less than I earned.”

If we buy a house for ourselves, nobody questions the purchase. No one says, “Wow, you bought a two-bedroom fixer-upper starter home?! You must be loaded!”

But if we buy an investment property, people raise eyebrows. “Are you some fancy-pants investor? Where did you get that kind of money?”

We’re spending the same amount of money as our next door neighbor, but we’re buying different things. They bought a boat; we bought investments.

Society says that’s weird. They’ll raise eyebrows, ask questions and make assumptions. Be okay with that. You’re part of a rebellion.

It’s a rebellion against mediocrity. A rebellion against following the herd and getting the same results. If you spend the way that everyone else does, you’ll carry the same debts that they do. You’ll work until you’re 68, then look back and wonder: “Is this all there is?”

You deserve better.

#6: You Make Money Going Into the Deal.

Speaking of not following the crowd –

Do you hear people say things like:

- “Damn, this stock dropped. I want to break even. I’ll hold onto it until it comes back up.”

- “I paid too much for this house. But that’s okay. I’ll make it back when I sell it.”

- “I don’t know how much the insurance/taxes/maintenance for this investment property will cost. But if they’re high, I’ll just raise the rent.”

Here’s the hard truth:

- Your stock doesn’t care whether or not you ‘break even.’

- Your homebuyer doesn’t care what you paid.

- Your renters don’t care about your overhead.

Successful investors don’t hope that the market will save them from their mistakes. Hope is not an investment strategy.

Your investments don’t succeed in the future. They succeed in the present, when you score a sweet deal on an undervalued asset.

If you’re hoping that a house or stock “hopefully rises in value in the next few years,” you’re speculating, not investing. Want to be an investor? Start with one hard truth: You make your money going in, not coming out.

#7: Fix the Right Problem.

Some people utter clichés like, “it’s not what you earn, its what you save.”

That’s half-true — but also half-false.

Many people have nailed the frugality aspect of the game. But despite their fantastic financial habits, they’re still struggling – not because they have a spending problem, but because they have an earning problem.

I hear from readers who say they’d love to save more, but they only earn $25,000 per year. Their problem isn’t a lack of savings. It’s a lack of income. All the frugality advice in the world won’t help them as much as a supplemental side income could.

In 2006, I earned a salary of $21,000 per year. I saved 15 percent, but this didn’t amount to much in raw dollars. After I started earning $100,000+ per year, life became a lot easier.

Clichés like “it’s not what you earn, it’s what you save” are misguided. Your income determines how much you can save, particularly at the lower end of the scale. Earning more is powerful. Everything stems from this starting point.

Read these real-life examples of people who dramatically boosted their income on the side:

- Julia grew her income from $8.50 per hour to $250 per hour as an artist.

- Erika earned an extra $20,000 on the side while working full-time and attending grad school.

- Randy bought his first income-producing rental property while supporting a family of five.

Not interested in real estate, aren’t sure what marketable skills you have, and love pets? Then try giving pet sitting or dog walking a try.

With Rover, everything is taken care of – you won’t need to market any services or go searching for clients. All that’s required is completing their sign up and registration process. Once that’s done, you’re listed as a pet sitter or dog walker on their site, with the potential to earn $100 a week (or more). Awesome, right?

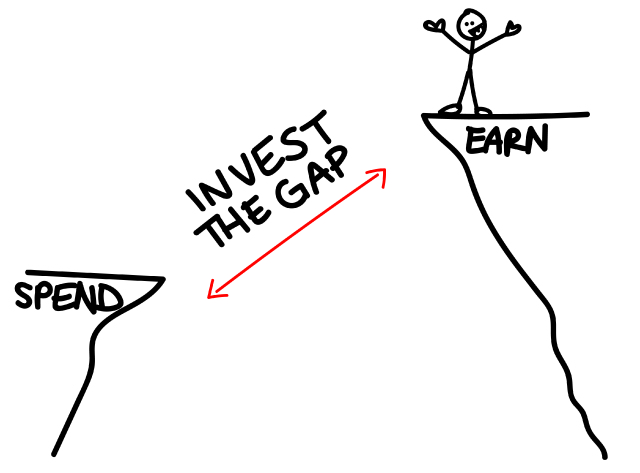

#8: Mind the Gap

Let’s talk more about that cliché, “it’s not what you earn, it’s what you save.”

The part that says, “it’s not what you earn” is dead-wrong. But the part that cheers “it’s what you save” is onto something. Those savings create a space that I refer to as “the gap.” This is the space between your income and your spending. Your job is to grow this as wide as possible.

At the risk of sounding like Captain Obvious, the two ways to grow this gap are by earning more and spending less.

The core of money-management is simple:

- Create the gap.

- Invest the gap.

- Repeat until the gap can perpetuate itself.

That’s it. This entire conversation, this whole “money thing,” is a conversation about that gap.

When your investments cover your day-to-day living expenses while also growing the gap, you’ve won the game. Your money is making its own money. Your income comes from capital, rather than labor.

Your job, in other words, is to create a gap that immortalizes itself.

Once that happens … drop the mic. You’re done.

#9: Try the Anti-Budget

Hey, I want to let you in on a secret:

Even though I’m a finance blogger, I don’t have a detailed budget.In fact, I think budgets are restrictive, tedious and boring-as-nails. And that’s okay. I work with this tendency, rather than fight it.

That’s why I coined the anti-budget, the easiest budget on the planet. The concept is dead-simple:

- Pick a savings rate.

- Pull your savings from the top.

- Relax about the rest.

You don’t need to worry about how much you’re spending on toilet paper vs. cat food vs. shampoo. Just pull your savings from the top. Live on whatever is leftover, guilt-free.

How do you handle that leftover money? First, pay the bills. If there’s more money remaining, treat yourself to whatever luxury you want. You saved first. The rest is yours to enjoy.

“How much should I save?”

You might not be able to hit this right away, but as an ultimate goal, I recommend at least two benchmarks:

- Save $1 out of $5 – I’m a firm believer that everyone should save at least 20 percent of his or her income.

- Save Half – If you’re chasing wealth or financial independence, save half. I know this sounds extreme. But it’s a turbo-accelerant.

When I say “save,” I’m referring to any activity that boosts your net worth, including:

- Crushing debt (making extra payments beyond the minimum)

- Investing in real estate, retirement accounts, etc.

- Literal savings (cash in a savings account)

If you’re a dual-income couple, the quick-and-dirty method is to live on the lesser of your two incomes. Live on one income and save 100% of the other. If you later literally become a one-income couple (e.g., to care for children), you’re set. You can easily adapt to losing the second income. Plus, you’ll have years of accumulated savings and investments behind you.

If you’re single, yank half your income from the top, anti-budget style. Move this into a savings account at a different bank, so it’s “out of sight, out of mind.” Keep an emergency fund; pour the rest into investments and/or aggressive debt payoff.

“Uh … I’m currently saving zero percent. My goal isn’t to save half – my goal is simply to save something. How can I hit 20 percent, or even 10 percent?”

That transitions perfectly to the next point …

#10: Start the One Percent Challenge.

Calculate one percent of your income by chopping two zero’s from your monthly earnings.

- If you make $2,000 per month, one percent is $20.

- If you make $4,000 per month, one percent is $40.

- If you make $8,000 per month, one percent is $80.

This month, save one percent more than normal. If you save zero percent of your income, save one percent this month. If you save 10 percent, save 11 percent this month.

Next month, boost it by one percent more. The following month, one more. After a year, you’ll save 12 percent more money than you tuck away today.

Do you currently save nothing? If you follow this plan, you’d be saving 12 percent of your income within one year. That’s 2x — 3x better than the average American.

(Fun fact: The personal savings rate for the average American has hovered between 4 to 5 percent during the past few years. But it wasn’t always this way. In May 1975, the average American savings rate stood at 17 percent. By July 2005, it dropped to less than 2 percent. Does anyone else find that fascinating? Or is it just me?)

Okay, where were we? Ah, right. You’ve started the Challenge. Let’s see how far it takes you:

- After 1 year, you’re saving 12 percent.

- After 2 years, you’re saving 24 percent.

- After 4 years and two months, you’re saving 50 percent — even if you’re starting at zero today. Raises or side income will further fast-track your progress.

You can modify this Challenge into earning an extra one percent every month. If you earn $5,000 per month, could you make an extra $50 this month? Could you both earn and save an extra $50?

If you’re interested, join the Afford Anything Facebook group to meet other like-minded people in this community.

#11: Retire Early and Often.

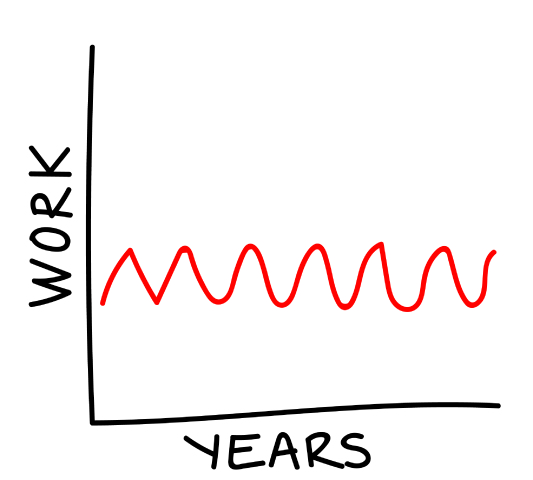

The work-then-retire model is full of flaws. Workers feel frazzled; retirees often feel bored. Here’s what the traditional retirement model typically looks like:

Early retirement is an improvement, but it also has some flaws:

I take a different approach: sprinkle mini-retirements throughout your life while you’re on the road to an early retirement. Retire both early and often.

Work/life isn’t a marathon, it’s a series of sprints. I believe in creating a work/life model that’s based around sprinting, strolling, sprinting, strolling. Work hard for awhile, then rest and repeat.

Don’t just retire once. Retire constantly. These mini-retirements can last from two weeks to two years. At the short end, it’s an extended vacation. At the long end, it’s a sabbatical.

I recommend several small doses of mini-retirements while you’re on the road to early retirement.

While you’re running work/rest intervals, simultaneously carve a path to permanent rat race escape. Although we’re calling this “early retirement,” you don’t need to quit your job or shutter your business. You should simply hold the option to quit, if you choose.

The most accomplished figures in our society – Elon Musk, Mark Zuckerberg, Warren Buffet, the late Steve Jobs – have the freedom to stop working anytime they choose. Their work is driven by passion, not necessity. Elon Musk isn’t trying to send a million humans to Mars in an effort to pay his mortgage. (There are easier ways to make money.) He wants to leave a legacy.

I understand that 99.99 percent of us won’t achieve that level of wealth, and that’s fine. It takes a relatively modest amount of money to create the freedom to live a passion-driven life.

Build sufficient investments that the cash flow can cover your bills. That’s the ultimate goal, and it’s enough to escape the cycle of trading-time-for-money. But also understand that this is a decade+ project, and you’ll need to break for some mini-retirements along the way.

Retire both early and often.

#12: Start

My final lesson (for now): Start. Choose one action, however small, that you can do today. Great victories are the result of marginal gains accumulating over time. So start now.

Love this post? Want more? Make sure you subscribe (it’s free!), so you never miss an update.