Got a little extra free time around the holidays?

Taking a few days off?

This is a perfect time to settle down with a few books.

(I know, I know. Leave it to me to take a nerd approach to the holidays.)

I’ve compiled a list of some of my favorite books about money, investing, real estate, productivity and happiness.

If you have some free time this month and you’re looking for great reads, check these out.

If you recommend other books that aren’t on this list, PLEASE drop a line in the comments! Tell this community what you love reading. Share your favorite books with the world. 🙂

Here we go:

How Rich People Think , by Steve Siebold

, by Steve Siebold

This is an easy read that cuts straight to the chase.

Steve structured this into 100 ultra-short chapters, each roughly two pages long. Every chapter illustrates a high-level concept. Here are some examples:

- The middle class plays it safe. The rich take wise, calculated risks.

- The middle class thinks wealth is a solitary effort. The rich know its a team effort.

- The middle class thinks ambition is a sin. The rich think ambition is a virtue.

- The middle class assumes you must choose between family or money. The rich know you can enjoy both.

- The middle class sets low expectations to avoid disappointment. The rich set high expectations to stay excited.

There’s no need to read front-to-back. Feel free to skip around.

- Read This If: You want an overview on cultivating a wealth mentality.

- Don’t Bother Reading If: You want actionable specifics.

Your Money or Your Life , by Vicki Robin and Joe Dominguez

, by Vicki Robin and Joe Dominguez

This is the original financial independence classic.

Released in the 1990’s (and updated a few years ago), this New York Times Bestseller popularized the movement of hopping off the trading-time-for-money hamster wheel.

The book is filled with gems, but here’s one of my favorite (actionable) pieces of advice in this book:

Compare your lifetime earnings to your net worth. Keep score against yourself.

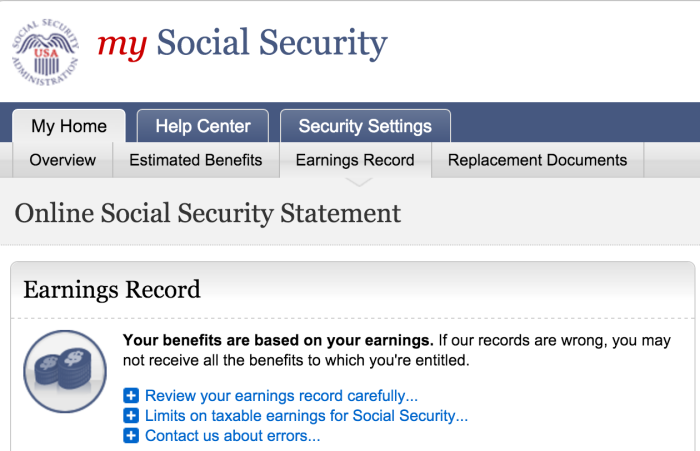

If you live in the U.S. and if most of your income is subject to Social Security tax, the easiest way to view your lifetime earnings is by logging into the Social Security website and clicking on the link that says: “View Earnings Record.”

You’ll see a list of taxed Social Security earnings, organized by year. Download these into an Excel file, then find the sum total.

These are your lifetime earnings.

Next, view your net worth, which is measures what you own, minus what you owe. It’s your assets minus liabilities.

Link your accounts to Personal Capital (free) to track your net worth automatically. (That’s an affiliate link; here’s my ethical policy.)

The dashboard in Personal Capital will show your net worth at-a-glance:

Voila — in less than 30 minutes, you’ll understand your lifetime earnings compared to your net worth.

That’s a great way to keep score.

Millionaire Teacher , by Andrew Hallam

, by Andrew Hallam

Andrew and I have been friends ever since I launched this website back in the Neolithic Era (ahem, 2011).

Andrew is a high school teacher who built a million-dollar investment portfolio by age 38. He’s a high school teacher AND a millionaire — how cool is that?!

Here’s how he did it:

- He “minds the gap.” There’s a gap between earning and spending; the “secret” to smart money is to widen this gap. There are only two ways to do this: earn more, spend less.

- He hustles to earn more. He tutors students on the side, for example, during his time off.

- He’s not a big spender. He finds joy in simple things.

- Then he invests the gap.

- He invests in index funds. Simple, easy, cheap, awesome.

…. and that’s it!

His writing is clear, simple, and jargon-free. His message is common sense, which is why it’s surprising that so many people don’t follow it.

- Read This If: You’ve ever uttered the words “I don’t earn enough to become a millionaire.”

- Don’t Bother Reading If: You’re an advanced investor.

The Millionaire Next Door , by Thomas Stanley and William Danko

, by Thomas Stanley and William Danko

The richest people in the U.S. don’t live on Park Avenue. They live next door.

These were the findings of two researchers who interviewed dozens of American millionaires in search of common threads. They discovered:

- The majority didn’t inherit anything from their parents, not even $1.

- Most have “cheap” tastes; they prefer Bud Light to fancy champagne.

- They drive used cars and live in middle-class houses.

- They own non-glamorous businesses. “We are welding contractors, auctioneers, rice farmers, owners of mobile-home parks, pest controllers, coin and stamp dealers, and paving contractors.”

- They are your next door neighbors. And you have no idea they’re rich.

Most millionaires invest their money, which is how they become (and stay) millionaires. The media loves to spotlight Kim Kardashian and Paris Hilton, but they’re the exception, not the norm.

- Read This If: You hold the limiting belief that you can’t be a millionaire.

- Don’t Bother Reading If: You want concrete, actionable instructions.

The Little Book of Common Sense Investing by Jack Bogle

by Jack Bogle

Thinking of toying around with mutual funds and individual stock selection?

Don’t bother.

In this epic classic, Jack Bogle — the founder of Vanguard — throws down the gauntlet, explaining why index funds are the Mac Daddy of investments.

If you’ve ever wondered why so many personal finance bloggers are index fund devotees, this book nails it.

- Read This If: You want to understand smart stock market investing. Or you’ve tried to articulate why you love index funds, but can’t figure out how to put it into words.

- Don’t Bother Reading If: You love index funds and don’t need any further confirmation why.

Common Stocks and Uncommon Profits , by Philip Fisher

, by Philip Fisher

There are two popular stock market investing philosophies: value investing and growth investing.

- Value investors look for strong companies that are momentarily underpriced. They’re the bargain-hunters of the stock market world.

- Growth investors focus on companies with tremendous growth potential. They’re willing to pay full retail price for a company that could be the Next Big Thing.

This book is written by the late Philip Fisher, known as the “Father of Growth Investing.” (Ironically, his son is a value investor.)

His colleague, the late Benjamin Graham, is known as the “Father of Value Investing.”

If you want to understand these two theories, read one book from each author.

I read Common Stocks and Uncommon Profits a few years ago, when I wanted to build a knowledge foundation around investing theory.

I decided I’d stick with simple index funds (following the teachings of my favorite investor, Jack Bogle), so I’ve never needed to apply these ideas. But knowing this background is handy. It helps me make more informed decisions.

- Read This If: You’re a finance enthusiast who wants to learn investing principals.

- Don’t Bother Reading If: You don’t care about theory. You just want to know action to take. (Buy index funds.)

The Intelligent Investor , by Benjamin Graham

, by Benjamin Graham

Warren Buffet says that his philosophy is 85% Benjamin Graham and 15% Philip Fisher.

Don’t read one without the other.

If you’re interested in learning investing theory, read these two books together. (And then follow Jack Bogle’s advice) 🙂

- Read This If: You’d like a foundation in stock investing ideas.

- Don’t Bother Reading If: You want to cut to the chase. (Stick with index funds. End of story.)

From 0 to 130 Properties in 3.5 Years , by Steve McKnight

, by Steve McKnight

This is the first book about real estate investing I ever came across, and it planted the seed of an idea that led me to where I am today.

This book helped me learn how to think like a buy-and-hold real estate investor.

It’s a mindset book, not an actionable “how to” instructional.

Huge disclaimer: The information about laws, taxes, banking, financing, etc., applies only in Australia. Read it for the high-level concepts, not the specifics (unless you’re also Australian).

- Read This If: You want to develop the mindset of a rental property investor.

- Don’t Bother Reading If: You want actionable, concrete information.

The Millionaire Real Estate Investor , by Gary Keller

, by Gary Keller

Wow, I’m recommending a lot of mindset-related books, aren’t I?

Here’s another.

Gary Keller, the co-founder of Keller Williams brokerage, writes about “myth-understandings” (myths and misunderstandings) about investments. Specifically:

- Myth: Investing is risky.

- Reality: Investing is risky if you don’t know what you’re doing.

If you buy the wrong property, you’re screwed. If you buy correctly, however, you remove risk.

- Myth: Investing is complicated.

- Reality: Investing is only as complicated as you make it.

When you’re in kindergarten, 5th-grade math seems hard. It’s all about perspective.

- Myth: Good investors time the market.

- Reality: Good investors make the best of the current time.

Great investors don’t blame the market. They seize all current market situations for opportunity.

- Read This If: You’d like to develop an investor mindset.

- Don’t Bother Reading If: You want actionable, concrete information. Also, don’t bother if you’re an advanced or experienced real estate investor.

I’m going to whip through these, because it’s a long list:

- Getting Things Done

by David Allen. Classic book that taught me the importance of maintaining Inbox Zero, a goal that I reach about once every three months. 🙂

- The 4-Hour Workweek

by Tim Ferriss. Another classic. This taught me to “fire my clients” — get rid of the paying clients who create the most hassle, so I can focus my limited time on good clients. It also taught me the significance of the “80/20 Principal” — 80 percent of your results come from 20 percent of your efforts.

- The ONE Thing

by Gary Keller. Yes, this is the second book by Keller that appears on this list. 🙂 In this book, Keller recommends that you start everyday by asking yourself: “What’s the ONE thing I could do today, such that by doing it, everything else becomes easier or unnecessary?” By focusing on the highest-leverage opportunity, you create a life that’s easier and more productive. Huge thanks to my friend David at Money Under 30 for recommending this book to me.

- The Power of Habit

, by Charles Duhigg. This book blew my mind. We’re ruled more by mindless habit than active decision-making — and that means we can change our actions by paying attention to triggers.

- Stumbling on Happiness

by Daniel Gilbert. I’ll never order a meal at a restaurant in the same way again. If you’re curious about why your mind operates in the way in which it does — and more importantly, if you’d like to be aware of your cognitive biases so you can make better decisions — read this book.

That’s it for today!

I’d love to hear from you. What are some of your favorite books? Please share it in the comments, for the benefit of the rest of the Afford Anything tribe!